MicroStrategy CEO says the company’s strategy is to buy and hold Bitcoin, not sell.

The company has over $5 billion worth of BTC.

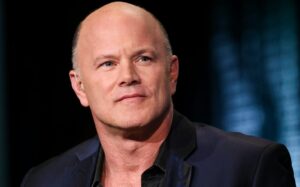

The CEO of MicroStrategy Michael Saylor says that the business intelligence firm, and one of the biggest holders of Bitcoin, has no plans to sell its holdings.

Not even when the cryptocurrency space continues to face headwinds in 2022 following a stellar 2021 that saw most crypto assets hit new all-time highs.

Bitcoin price raced to a peak of $69,000 in November last year, with the flagship cryptocurrency outpacing the S&P 500 for the fourth year in a row. However, the price has fallen significantly over the past two months. In the past 30 days, BTC’s price has declined 13%.

After closing 2021 with over 70% in gains, the correction has seen gains over the past year cut to just 14%.

Asked if the crypto winter is something that worries him personally, Saylor noted:

“If you are going to invest in Bitcoin, a short time horizon is four years, a mid time horizon is ten years, [and]the right time horizon is forever.”

He told Bloomberg that his company isn’t in the business of selling, and when asked what happens if prices tank further, the MicroStrategy chief responded:

“We’re not sellers. We’re only acquiring and holding Bitcoin. That’s our strategy,”

During the interview, Saylor noted that price declines across crypto don’t worry him at all. He also expressed confidence in Bitcoin as an inflation hedge.

According to him, the cryptocurrency offers “the best defense against inflation” and nothing currently beats holding the Bitcoin standard.

“I don’t really think we could do anything better to position our company in an inflationary environment than to convert our balance sheet into bitcoin,” he explained.

Saylor added that the company’s decision to buy Bitcoin stemmed from observations made across the industry. He said doing “nothing”- referring to a situation where the MicroStrategy had not bought any BTC- would be consequential.

He said he has witnessed 99% of competitors close shop, and that he felt the company would be “headed” in that direction if they maintained the status quo. Rather tellingly, he noted that the company faced two options: to “either adopt a Bitcoin strategy, or sell the company.”

He said they chose to buy the digital gold.

MicroStrategy‘s holdings number 124,391 BTC after a series of purchases following its pioneering move in 2020. At current prices, the company’s haul is worth over $5 billion.

The post MicroStrategy isn’t in the business of selling Bitcoin even if prices crash, says CEO Michael Saylor appeared first on Coin Journal.